Betfair Exchange in 2026: how the betting exchange works, fees and user risks

Betfair Exchange remains one of the most recognisable peer-to-peer betting markets in 2026. Unlike traditional bookmakers, it operates as a matching environment where users bet against each other rather than against a house. This model changes how odds are formed, how fees are charged, and where risks actually sit. Understanding these mechanics is essential for anyone considering regular use of an exchange rather than fixed-odds betting.

How Betfair Exchange works in practice

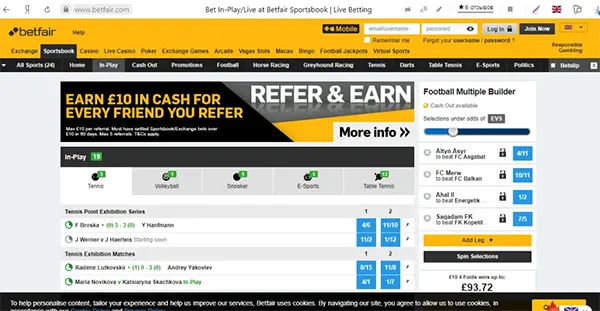

At its core, Betfair Exchange connects two types of users: those who want to back an outcome and those willing to lay it. A back bet means supporting an outcome to happen, while a lay bet means taking the opposite position and effectively acting as the bookmaker. The exchange matches these positions at agreed odds, with Betfair facilitating the transaction rather than setting prices.

Odds on the exchange are driven by market demand. When many users want to back the same outcome, odds shorten; when more users are willing to lay it, odds drift. This market-driven pricing often results in tighter margins compared to traditional bookmakers, especially on high-liquidity events such as major football leagues, horse racing, and tennis.

In 2026, Betfair Exchange still relies on real-time matching and partial fills. If no opposing bet is available at the requested odds, the bet remains unmatched until liquidity appears or odds move. This can be an advantage for price-sensitive users but also introduces execution risk during fast-moving events.

Back and lay betting explained clearly

Back betting on the exchange follows familiar logic: you stake an amount and receive profit if the outcome occurs. Lay betting is less intuitive. When laying, the user accepts another person’s stake and risks a larger liability if the outcome happens. The liability depends on the odds and must be available in the account balance.

This structure allows users to hedge positions. For example, a bet can be backed early at higher odds and later laid at lower odds, locking in profit regardless of the result. Such trading strategies are common on exchanges but require discipline and precise understanding of odds movement.

However, lay betting increases exposure to mistakes. Misjudging liability, placing bets at the wrong odds, or failing to exit positions in volatile markets can result in losses that feel disproportionate compared to traditional betting.

Commission structure and real costs in 2026

Betfair Exchange does not charge fees on losing bets. Instead, commission is applied to net winnings on a market. For most users in 2026, the standard commission rate remains up to 5%, depending on location, activity level, and chosen rewards structure.

Commission is calculated after the market settles. If a user wins multiple bets in the same market, only the net profit is considered. This is one of the reasons why exchange betting can be more cost-efficient than fixed odds over time, particularly for frequent or high-volume users.

However, commission is not the only cost. Users who consistently generate profits above certain thresholds may be subject to additional charges, which significantly change the economics of long-term exchange use.

Premium and expert-related charges

In recent years, Betfair replaced the traditional Premium Charge for many users with revised expert-related fee structures. In 2026, these mechanisms still aim to ensure that highly profitable accounts contribute a minimum percentage of gross profits in fees over time.

The calculation is complex and based on lifetime profitability, commission paid, and activity history. While most casual users never encounter these charges, experienced traders can see effective fee rates rise well above standard commission levels.

This creates a structural consideration: the exchange rewards liquidity provision and casual participation but becomes less favourable for consistently profitable strategies at scale. Anyone planning long-term trading should factor this into realistic profit expectations.

Key risks users should understand

One of the main risks on Betfair Exchange is liquidity risk. Not all markets have sufficient depth, especially lower-tier sports or niche events. Limited liquidity can prevent bets from being matched or force users to accept worse odds than expected.

Another risk is price volatility. Odds can change rapidly due to in-play events, news, or large orders entering the market. Users placing manual bets may find themselves exposed if markets move faster than anticipated.

Operational risk also exists. Misclicks, incorrect stake sizes, or misunderstanding lay liabilities are common causes of avoidable losses, particularly for newer users transitioning from traditional bookmakers.

Risk management and responsible use

Effective risk management on the exchange starts with clear staking rules. Users should always understand maximum liability before placing a lay bet and avoid using the full available balance on a single position.

Using unmatched bets and setting odds limits can reduce execution risk, while avoiding low-liquidity markets helps prevent being trapped in unfavourable positions. Many experienced users also rely on pre-defined exit points rather than emotional decision-making.

Finally, exchange betting requires continuous self-assessment. Strategies that work in certain market conditions may fail in others, and fee structures can erode margins over time. Treating Betfair Exchange as a technical betting environment rather than a casual alternative helps align expectations with reality.